Asian stocks faced mixed results as US shares continued their losing streak, with Japanese stocks falling while Australian and South Korean equities rose. Key tech firms in Asia and the US, like Taiwan Semiconductor Manufacturing Co. and Nvidia Corp., are closely monitored. US chipmaker Micron Technology Inc. is set to receive over $6 billion in grants to boost domestic production. US stock pullback raises doubts despite strong economic data. Treasury market sees dip buyers after Powell's rate-cut comments. Dollar stabilizes after recent decline. Oil prices drop on weak Chinese data. Gold prices rise slightly.

Asia stocks declined as tensions in the Middle East escalated after Iran's attack on Israel, leading to a shift in investors seeking safer assets. Oil prices fell despite the conflict. The U.S. dollar rose against the Japanese yen. Chinese equities faced challenges after a miss in trade data. Market volatility is expected as uncertainty looms over potential regional war. Gold and Treasury yields rose as investors sought safe havens. Bitcoin rallied after initial losses. Stock markets in Saudi Arabia and Qatar posted modest losses. Brent crude traded around $90 a barrel.

Most share indices in Asia-Pacific were trading higher with the Nikkei 225 down by 0.34% to 37,831.61, the KOSPI index up by 1.22% to 2,615.66, and the S&P ASX 200 up by 0.36% to 7,633.10. Taiwan Manufacturing Co. and Tokyo Electron Ltd are set to report quarterly results. US bond market under pressure with speculation on rate cuts. Various indices in the US fell, Brent crude traded higher at $87.36, and gold rose to $2,369.67. India's benchmark indices fell due to geopolitical concerns, with net selling by foreign investors and buying by domestic institutional investors. Tata Communications reported revenue up 1.0% and net profit up 613.7% in the latest quarter.

(Bloomberg) -- Global equities showed signs of stability following a recent selloff. Asian currencies remained in focus as traders braced for the Federal Reserves higher-for-longer interest rates. Most Read from Bloomberg Dubai Grinds to Standstill as Cloud Seeding Worsens Flooding What If Fed Rate Hikes Are Actually Sparking US Economic Boom? China Tells Iran Cooperation Will Last After Attack on Israel Powell Signals Rate-Cut Delay After Run of Inflation Surprises US Yields Spike as Hawkish Powell Puts 5% in Play: Markets Wrap US and European equity futures inched higher as the MSCI Asia Pacific Index steadied after an earlier drop. The dollar turned lower following its best five-day gain since October 2022. The greenbacks resilience has exerted pressure on global emerging-market currencies and prompted authorities to ramp up defense against rapid depreciation.

Stocks like Taiwan Semiconductor Manufacturing Co. and Apartment Income REIT Corp. saw gains, with the White House pledging $6.6 billion for Taiwan Semi's facility expansion in Arizona. However, Paramount Global and Occidental Petroleum Corp. experienced declines. JPMorgan Chase CEO Jamie Dimon remains optimistic about the U.S. economy's growth. Model N Inc. agreed to be acquired, while Perion Network Ltd. reduced its full-year forecasts. Spirit Airlines deferred aircraft deliveries and planned pilot furloughs due to economic challenges.

(Bloomberg) -- European equity futures tracked the grim Asian session as signs of fading momentum in Chinas economy added to angst over elevated US interest rates and tensions in the Middle East. Most Read from Bloomberg Beyond the Ivies: Surprise Winners in the List of Colleges With the Highest ROI Trump Medias $5.3 Billion Selloff Deepens as 270% Rally Fizzles S&P 500 Breaks Below 5,100 as Big Tech Sells Off: Markets Wrap Irans Attack on Israel Sparks Race to Avert a Full-Blown War Apple Faces Worst iPhone Slump Since Covid as Rivals Rise The Euro Stoxx 50 contract dropped over 1%, while contracts on US stocks were steady after the S&P 500 slid to the lowest in more than a month overnight following robust retail sales data. In Asia, a gauge of regional stocks tumbled the most since August, with every major market seeing broad-based losses, after a slew of Chinas economic indicators showed that the nations economic recovery remains patchy. A global index of emerging market currencies dropped, with South Koreas won and the Indonesia rupiah weakening to multi-year lows.

The resurgent dollar's strength has led to Asian currencies like the Indian rupee, Indonesian rupiah, South Korean won, and others weakening, with geopolitical tensions and strong US retail sales data contributing to the dollar's gains. Asian stocks have also extended losses, with emerging-market equities falling about 2%. Central banks in countries like Indonesia, South Korea, and Malaysia are stepping in to support their currencies against the dollar's pressure. Meanwhile, the Indian rupee is expected to reach a lifetime low below 83.50 against the dollar due to risk aversion and Fed rate cut delay concerns.

European stocks climbed 0.6% driven by positive developments in the technology sector and higher resource prices. The surge in sales at Taiwan Semiconductor Manufacturing Co boosted European tech stocks, while miners advanced on gains in copper, iron ore, and gold. US stock futures remained stable, with investor focus on the upcoming inflation data, expected to show a 0.3% rise in US consumer prices for March. The market anticipates around 65 basis points of Fed rate cuts by year-end. Global equities are facing challenges despite a strong first quarter performance in 2019, as US economic data remains robust.

Most U.S. stocks slipped as Treasury yields rose, with the S&P 500 falling 0.2%, Dow Jones rising 0.2%, and Nasdaq falling 0.1%. Federal Reserve officials signaled no immediate interest rate cuts, causing market weakness despite positive corporate earnings. Fed Chair Powell's comments on inflation led to record-high Treasury yields and a shift in rate cut expectations to September. Strong earnings from companies like UnitedHealth supported the market. Treasury yields rose further, reflecting investor concerns. Corporate earnings exceeding estimates boosted investor confidence amid geopolitical tensions. Federal Reserve officials will continue to speak this week.

US stocks slid on Wednesday, with the S&P 500 ending with its fourth straight loss as tech stocks led the market lower and investors adjusted their rate expectations following this week's hawkish comments from Jerome Powell. Nvidia led the loss in tech through the session, with shares of the chip maker sliding by almost 4%. Tech titans like Netflix, Meta, Apple, and Microsoft all ticked lower, and the Nasdaq shed more than 1% on Wednesday. Investors are coming to terms with the prospect of higher-for-longer interest rates, thanks to a hot inflation print for March and Powell's recent guidance on rate cuts in 2024. The Fed Chair warned that central bankers needed more confidence that inflation was returning to its 2% target, implying rates would stay higher for longer than investors were expecting.

The US dollar is experiencing significant gains against major currencies, driven by doubts about US interest rate cuts. The Bloomberg Dollar Spot Index and US dollar index have surged, affecting emerging-market currencies like the Chinese yuan, South Korean won, Taiwanese dollar, Japanese yen, and Indian rupee. China's economic growth outlook and global trade tensions have added to the pressure on emerging-market assets, with the MSCI Emerging Markets Index and its currency counterpart facing declines.

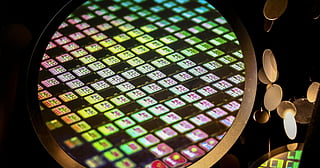

(Bloomberg) Taiwan Semiconductor Manufacturing Co.s quarterly revenue grew at its fastest pace in more than a year, shoring up expectations that a global boom in AI development is fueling demand for high-end chips and servers. Most Read from Bloomberg US Slams Strikes on Russia Oil Refineries as Risk to Oil Markets Bond Trader Places Record Futures Bet on Eve of Inflation Data Irans Better, Stealthier Drones Are Remaking Global Warfare Trumpism Is Emptying Churches Ukraine Says Its Behind Blaze on Russian Warship in Baltic Sea The main chipmaker to Nvidia Corp. and Apple Inc. reported a better-than-expected 16% rise in March-quarter sales to about NT$592.

US stock futures climbed with Dow Jones Industrial Average futures up by 0.3%, S&P 500 futures by 0.3%, and Nasdaq 100 futures by 0.4%. Chair Jerome Powell's reassurance on rate cuts boosted market confidence, shifting focus to the upcoming US jobs report. Expectations for further rate hikes due to economic acceleration have eased. Levi Strauss and BlackBerry saw stock increases due to positive corporate news. General Motors' stock has surged by 25% this year, outperforming Ford and S&P 500, attributed to improved EV execution and shareholder returns.

Japanese Prime Minister Fumio Kishida visited a new semiconductor plant in Kyushu, Japan, with over 1 trillion yen ($7 billion) of government support to secure chip supply. The plant, owned by Taiwan Semiconductor Manufacturing Co., highlights Japan's ambition to regain presence in the chip industry. Japanese companies like Sony and Toyota are investing in the TSMC subsidiary, aiming to reduce dependency on chip imports due to pandemic-era shortages affecting various industries.

US stocks surged on Thursday to fresh records, continuing the momentum in the wake of the Federal Reserve's latest monetary policy update. The S&P 500 and the Dow Jones Industrial Average claimed fresh record highs, with the Dow spiking by 269 points. The jumps add to gains that followed Jerome Powell's press conference on Wednesday, in which he said the central bank remains committed to its 2% inflation target, and that policymakers will monitor incoming data closely before its next moves. According to the dot plot of interest rate projections for the coming years, officials still expect three rate cuts in 2024. CME's FedWatch Tool shows traders have ramped up bets for a June rate cut over the last 24 hours, with odds for easing to start in June jumping from 55% to almost 70%.

A 7.4-magnitude earthquake hit Taiwan, briefly halting chip production at semiconductor factories crucial for Silicon Valley companies. Taiwan Semiconductor Manufacturing Co (TSMC) produces 92% of the world's most advanced chips, with its factories located on the western coast of Taiwan. TSMC reported minor tool damages but stated no major issues affecting chip production. The earthquake's impact briefly paused operations, affecting companies like Apple, Huawei, Nvidia, Tesla, and OpenAI dependent on TSMC chips.

The Chinese economy is on track to grow "around 5 percent" this year as per the government's target, supported in particular by robust infrastructure and manufacturing investment, and consumer spending is expected to pick up as well over the course of the year, said HSBC Chief Asia Economist Fred Neumann. In an exclusive interview with China Daily, Neumann said: "The data for the beginning of the year have been encouraging ... China's economy is likely to deliver a steady, gradual recovery.

The March consumer price index (CPI) report, set to be released, is anticipated to show a year-over-year jump of 3.7% in core CPI, slightly lower than the prior month. Analysts suggest that a cooling of inflation in March could lead to potential interest rate cuts by the Federal Reserve in June. The report's outcome will heavily influence stock and bond markets. This follows Fed Chair Jerome Powell's indication that interest rates could be cut in 2024 once inflation is under control. Inflation pressures persist with core prices expected to rise 3.7% annually.

Currency traders at the KEB Hana Bank headquarters in Seoul, South Korea, closely monitor the Korea Composite Stock Price Index (KOSPI) and foreign exchange rates, including the USD to South Korean won rate. The trading room also pays attention to updates on Mideast tensions. Meanwhile, in New York, people pass by the Fearless Girl statue near the New York Stock Exchange.

Benchmarks across Asia-Pacific region were trading lower for second session in a row Tuesday, tracking overnight losses on Wall Street. Traders are awaiting a slew of economic data from China, including GDP, retail sales. The Nikkei 225 was trading 736.53 points or 1.91% lower at 38,470.

Yahoo! News

Matthew Burgess

ABC News

Yahoo! News

Yahoo! News

https://apnews.com/author/elaine-kurtenbach

Business Insider

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA

PANORA