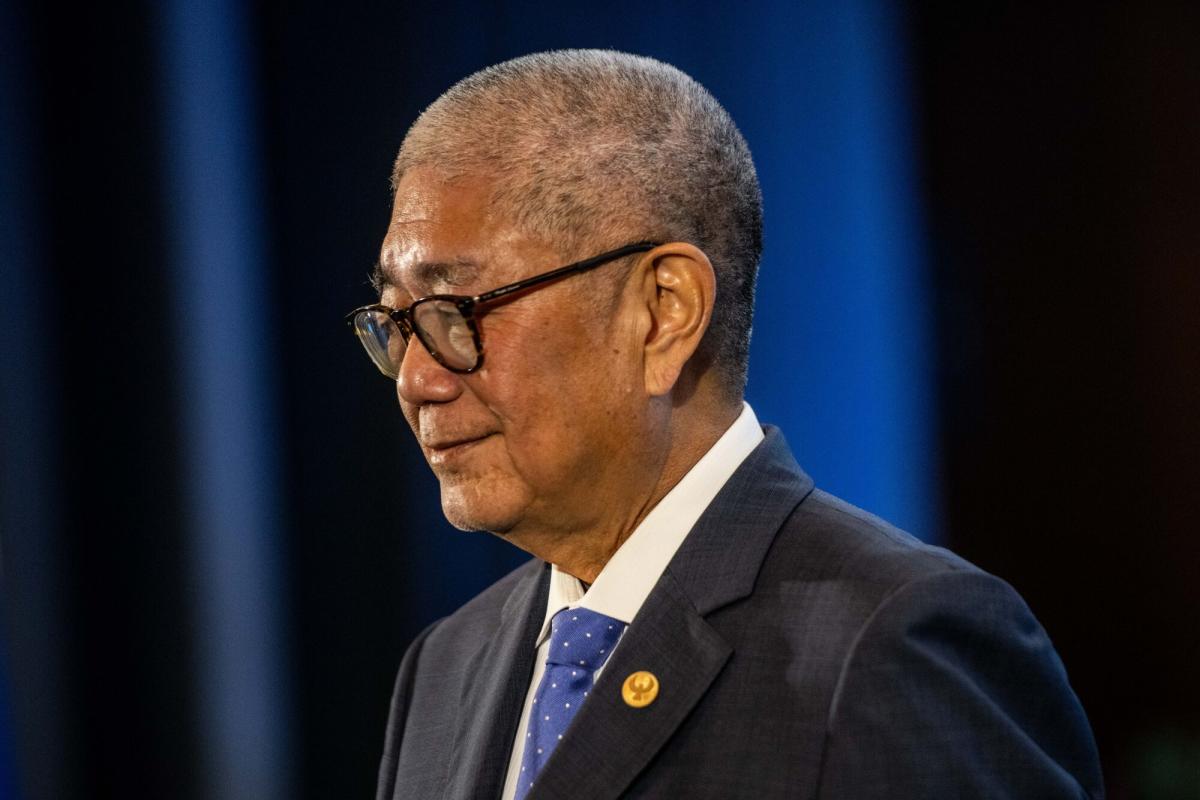

(Bloomberg) -- The Philippine pesos slide to a 17-month low isnt large enough to derail monetary easing later this year or early next year, according to central bank Governor Eli Remolona. Most Read from Bloomberg Dubai Grinds to Standstill as Cloud Seeding Worsens Flooding What If Fed Rate Hikes Are Actually Sparking US Economic Boom? China Tells Iran Cooperation Will Last After Attack on Israel Powell Signals Rate-Cut Delay After Run of Inflation Surprises US Yields Spike as Hawkish Powell Puts 5% in Play: Markets Wrap I would say the central scenario would be we ease in 4Q. If things are worse, then we might postpone to first quarter 2025, the Bangko Sentral ng Pilipinas governor said in his monthly briefing on Wednesday. The pesos movement so far is not going to change what we think we might be doing at the next policy meeting on May 16, he said. Emerging-market currencies including the peso have been under pressure in recent days as the odds of an early rate cut globally wane.

Yahoo! News

Yahoo! News